How To Triple Your Return With Advanced ETF Strategies (Leveraged ETFs & Inverse ETFs) - Daniel's Brew

Omicron volatility? How ETFs obliterated 2020's record, gathering $800 billion in new money so far in 2021 - MarketWatch

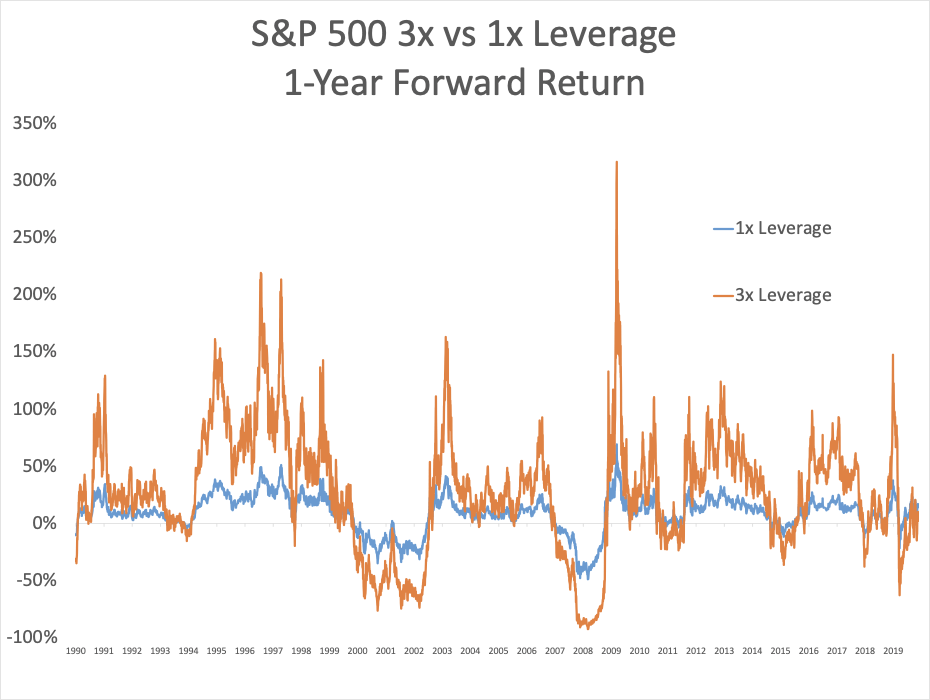

Direxion Daily S&P 500 Bull 3x Shares ETF: A Data-Driven Analysis Of Holding Long Term Leverage Risk (NYSEARCA:SPXL) | Seeking Alpha